|

|

|

|

|

Vancouver, BC, Apr 26, 2019 - (ACN Newswire) - Outcrop Gold Corp (TSXV: OCG) ("Outcrop Gold or The Company") is pleased to provide an update of the Company's work on the vein system that overprints its large La Custodia gold-copper porphyry deposit on the Cauca project in Colombia.

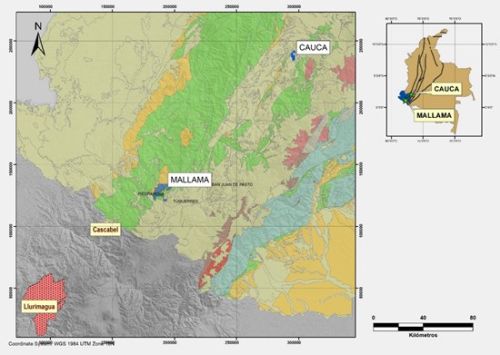

| | Figure 1. Cauca is in a 300 km Mineral Belt that includes Llurimagua and Cascabel in Ecuador and La Colosa in Colombia. Many world-class or giant deposits occur in this trend. |

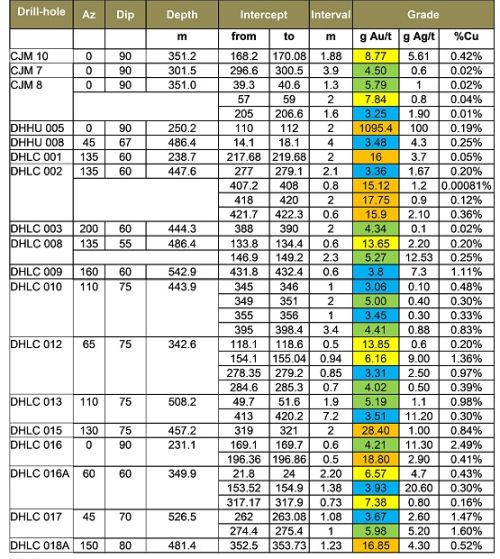

| | Table 1. Thirty-five vein intercepts in 18 core-holes in La Custodia range from 3.06 to 1195 g Au/t. An additional fifty-one vein intercepts not in the table range from 1.75 g Au/t to 2.95 g Au/t. True thickness is estimated at 57% of the intercept thickness for an average thickness of 1 m. |

| | Figure 2. Roadcut mapping shows vein orientation and distribution cutting porphyry-style mineralization. Here the veins have very consistent orientation. The veins are separated by mineralized porphyry-style mineralization. These orientations were used with drill intercepts to construct a preliminary 3D Vulcan model. |

| | Figure 3. Most veins occur in sheeted zones. To the right is a sheeted vein zone with a 1.7 m width. There are tensional veins between the sheeted veins and subsidiary veins in the footwall. |

| | Figure 4. Epithermal veins and veinlets within sheeted vein zones can be very high-grade and contain abundant coarse gold. Epithermal veins cut porphyry-style veinlets. These veinlets are parallel to core but probably part of a sheeted vein zone. |

| | Figure 5. A "schematic or exploration stage" vein model in section using observed primary vein trends-illustrated in Figure 2. Thirty-seven vein segments are supported by one to three drill intercepts. The grid is 500 m horizontal and 100 m vertical. Veins occur over 1.2 km distance in section. |

Cauca is an advanced gold-copper project in the Miocene-age mineral belt of southern Colombia - 47km south of the department capital Popayan - in the Almaguer Mining District - and consists of one title and one application for a total land area of 1,808 hectares. Over 22,000 m of historic drilling define the La Custodia deposit and other targets.

Figure 1. Cauca is in a 300 km Mineral Belt that includes Llurimagua and Cascabel in Ecuador and La Colosa in Colombia. Many world-class or giant deposits occur in this trend.

To view an enhanced version of Figure 1, please visit: https://bit.ly/2II6D9a

Outcrop Gold acquired the Cauca project after it recognized that the La Custodia deposit contained numerous epithermal veins, sheeted vein zones and breccia as an overprint to a large low-grade gold-copper porphyry.

Whereas the previous owner of Cauca completed non NI43-101 compliant resource estimations and non NI43-101 economic evaluations including metallurgical testing and an optimized pit design, they did not attempt to model the higher-grade veins. Numerous intercepts in eighteen core-holes in La Custodia examined by the Company show that the veins have high-grade gold values and appear to be well distributed through the porphyry. Since acquisition in June 2018, the company has worked to assess the character and distribution of these epithermal veins.

The Company has conducted core relogging, interpreted geology in cross-section, performed statistical grade-trend analysis and vein modeling in Vulcan 3D, performed roadcut mapping and sampling, and started a trenching program. This work has shown that the primary vein sets have predictable high-angle and generally parallel orientation. Vein zone widths are variable but are observed at surface to be from 0.10 m to 1.7 m. Locally in roadcuts vein spacing is observed to be from 5 to 7 m or less but vein zone spacing varies in the deposit. The veins are not a local feature but occur throughout the 1.5 km by 1.2 km area of the deposit.

The Company is working to define vein thickness, continuity, distribution and density in La Custodia. Historic drilling is too sparse and randomly oriented to determine these critical parameters accurately except locally, but the Company thinks the general potential of the veins can be assessed now by using historic drilling along with mapping and sampling on the ground to make preliminary vein projections in cross-sections and a 3D Vulcan model.

Outcrop Gold determined that in the eighteen core holes defining La Custodia, there are eighty-six epithermal vein-intercepts, with thirty-five of those intercepts over 3 g Au/t ranging from 3.25 g Au/t to 1095 g Au/t. For these thirty-five core intercepts, the weighted average is 8.1 g Au/t over 1.76 m after cutting the highest 1095 g Au/t intercept to 36 g Au/t. In addition to the thirty-five intercepts greater than 3 g Au/t, another fifty-one epithermal vein intercepts range from 1.7 g Au/t to 2.95 g au/t over 0.10 m to 2 m.

The Company infers the eighty-six intercepts represent thirty-seven vein segments. La Custodia is drilled on 100 to 200 m spacing and twelve of eighteen holes are vertical or very steeply inclined. The angle-holes in the deposit are rarely oriented perpendicular to the primary vein trend. It is likely that additional preferentially oriented drilling will increase the current count of epithermal vein zones while providing more accurate vein definition.

Table 1. Thirty-five vein intercepts in 18 core-holes in La Custodia range from 3.06 to 1195 g Au/t. An additional fifty-one vein intercepts not in the table range from 1.75 g Au/t to 2.95 g Au/t. True thickness is estimated at 57% of the intercept thickness for an average thickness of 1 m.

To view an enhanced version of Table 1, please visit: https://bit.ly/2UFDvAC

Figure 2. Roadcut mapping shows vein orientation and distribution cutting porphyry-style mineralization. Here the veins have very consistent orientation. The veins are separated by mineralized porphyry-style mineralization. These orientations were used with drill intercepts to construct a preliminary 3D Vulcan model.

To view an enhanced version of Figure 2, please visit: https://bit.ly/2Dv9JZB

Roadcut mapping and limited trenching show that the veins are commonly high-angle, parallel and sheeted within strong alteration halos. In Figure 2 eight or more veins and sheeted vein zones are present in 40 m of a roadcut with an average spacing of 7 m between veins. Two of the sheeted vein zones are greater than 1 m in true thickness. The observed vein density and thickness suggests that modeling the veins could contribute significant higher-grade volumes to the deposit.

Locally a low-angle vein set occurs that cuts the high-angle parallel veins with minor displacement. The low angle veins are poorly understood and first seen in roadcuts.

Figure 3. Most veins occur in sheeted zones. To the right is a sheeted vein zone with a 1.7 m width. There are tensional veins between the sheeted veins and subsidiary veins in the footwall.

To view an enhanced version of Figure 3, please visit: https://bit.ly/2vklbCT

Figure 4. Epithermal veins and veinlets within sheeted vein zones can be very high-grade and contain abundant coarse gold. Epithermal veins cut porphyry-style veinlets. These veinlets are parallel to core but probably part of a sheeted vein zone.

To view an enhanced version of Figure 4, please visit: https://bit.ly/2PxIYIT

The epithermal veins in detail are: (1) LS high-grade gold-silver in quartz with common free gold and naumonite (?) or (2) moderate to high-grade gold and copper in carbonate-quartz. The LS vein intercepts can assay up to 1095 g Au/t. The CBM-Au (?) veins can contain up 2.5% copper. The spatial relationship between LS and CBM-Au veins is not understood.

The Company has done very preliminary "schematic or exploration stage" block models of the veins based on drill intercepts and observation of vein trends on the ground. The model is schematic in the sense that while modeled vein segments are supported by one to three drill-hole intercepts, vein trends and thicknesses are approximate using average thicknesses and orientations. In detail the veins will be more complex and variable, but probably also more abundant in the deposit.

Figure 5. A "schematic or exploration stage" vein model in section using observed primary vein trends-illustrated in Figure 2. Thirty-seven vein segments are supported by one to three drill intercepts. The grid is 500 m horizontal and 100 m vertical. Veins occur over 1.2 km distance in section.

To view an enhanced version of Figure 5, please visit: https://bit.ly/2XI3ERp

More definitive work including trenching and drilling is needed but the Company's preliminary model of the vein system suggests the vein grades and their distribution could contribute significantly to historic grade estimations in the La Custodia deposit. Based on internal "exploration-stage" preliminary block modeling in La Custodia, thirty-seven vein segments could contain 70% of the gold in 20% of the volume in the deposit on a weighted average basis of vein mineralization versus porphyry-style mineralization could The Company estimates that the grade in veins versus grade in porphyry mineralization is more than twelve to one as an average and are thus a very important feature that needs to be modeled in the La Custodia.

Summary regarding La Custodia veins:

* Historic non NI43-101 compliant resource estimates and a pit optimization by the previous owner do not incorporate any vein modeling in La Custodia. By not taking the higher-grade veins into consideration grades in the deposit may be significantly underestimated.

* Preliminary 3D block modeling by the Company establishes that epithermal and CBM-Au veins are a significant part of the La Custodia deposit. Mapping roadcuts provide measured orientations to use with drill intercepts to project vein zones using average orientations and thicknesses. Eighty-six core intercepts were used to define 37 vein segments of 400 m in strike and 200 m in dip.

* This Outcrop Gold work was not for a resource estimation but to estimate potential grade contributions from the veins on a weighted average basis. In detail the veins will be more complex, and many more data points will be required before any resource-type work can be conducted.

* The previous owner provided a non NI43-101 compliant resource estimate for La Custodia of 31,000,000 tonnes at 0.506 to 0.660 Au-equivalent g/t in an optimized open-pit design using 0.48 g Au/t cutoff. The Company infers from exploration stage block modeling of veins and porphyry that the grade in veins versus grade in porphyry mineralization is more than twelve to one. If 10 to 15% of the La Custodia deposit is composed of vein zones that average 5 to 8 g Au/t over 1.0 m, and the veins are well distributed, the historic optimized pit grade could be increased by several multiples.

Regarding Historic Estimates:

Historic estimates were conducted and reported in 2012 by S.R.L. Geo Azul Adina and other outside consultants for the previous owner of the project. The Company has reviewed and also used a resource and design engineering consultant for the Company to and to provide a precursory review of some of the studies for quality. The historic work is considered independent of the previous owner of the project, and reliable and professional work using good industry standards by mining professionals. However, some of the work is conceptual in that not all data was enough for rigorous modeling. The resource category would be considered informally as "inferred" but not necessarily according to CIM standards for resource classification.

For global and pit constrained historic resources respectively a cut-off 0.375 of .480 g Au/t was used. Tonnes and grade estimations used conventional statistical studies and correlogram functions in a conventional block model created with Minesight modeling software. Model blocks were constrained by a plus 0.30 g Au/t three-dimensional "grade shell" used for the global resource. Intrusive types, saprolite, and alteration were classified in the underlying geologic model. Parameters for pit optimization were costs estimated for a 5,000 tonne per day, truck and shovel open-pit operation with gravimetric and mill recovery. Metal prices used were $1250 per ounce for gold, $18.50 per ounce for silver, and $2.05 per pound for copper. Metal recoveries based on metallurgical testing used 95% gravimetric recovery of gold in the oxide zone, and 85% recovery of gold, 80% recovery of copper, and 60% recovery of silver in the below the oxide zone.

The Company considers the historic estimations as reliable and relevant to assess exploration potential on the property. A qualified person has not done enough work to classify the historical estimate as current mineral resources and the issuer is not treating the historical estimate as current mineral resources. It is believed the historic estimation work completed in 2012 is the only work of this type done on the project.

QA/QC for Historic Drilling:

To ensure the quality of the sample preparation, verify the proper functioning of the laboratory, quantify the analytical accuracy, quantify the heterogeneity and representativeness of the samples blank, standard and duplicate samples were included in each lot of 30 samples submitted to a certified lab. 848 control samples were submitted which represents approximately 10% of the total number of drill assays. S.R.L. Geo Azure Andina, a mining services company of Peru who supervised all aspects of the La Custodia drilling for the previous owner of the project said at the time "in general it is considered that the results of the quality control (QA / QC) of the drilling program indicate that the techniques used for the supervision and control of the sampling personnel and / or the analysis laboratory are reliable. The few errors detected have been timely and satisfactorily cleared by the staff of the laboratories involved. The Company thinks the reported drill results are reliable for this stage of exploration.

About Outcrop Gold:

Outcrop is a gold prospect generator active in Colombia. Our emphasis is on acquiring gold exploration projects with world-class discovery potential. Outcrop performs its own grass roots exploration and then employs a joint venture business model on its projects to maximize investor exposure to discovery and minimize financial risk. Outcrop has Newmont Mining Corp. as an active funding partner on its Lyra project in Antioquia directly south of Buritica.

Qualified person:

The technical information in this news release has been approved by Joseph P Hebert, a qualified person as defined in NI43-101 and President and CEO to the Company.

ON BEHALF OF THE BOARD OF DIRECTORS:

Joseph (Joe) Hebert, Chief Executive Officer, and Qualified Person.

Tel: +1-775-340-0450

Email: joseph.hebert75@gmail.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Topic: Press release summary

Source: Outcrop Gold Corp

Sectors: Metals & Mining

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

|