|

|

|

|

|

|

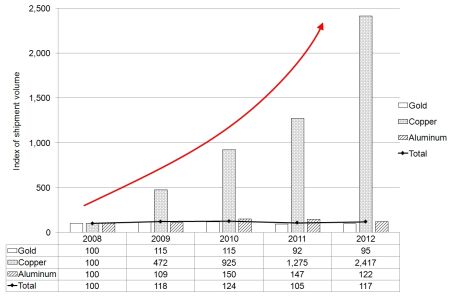

| The use of copper as an alternative material is gaining momentum due to gold prices soaring, resulting in the total shipment volume increased by approx. 10% from the previous year |

TOKYO, Apr 16, 2013 - (ACN Newswire) - Tanaka Holdings Co., Ltd. (a company of Tanaka Precious Metals) today announced that Tanaka Denshi Kogyo K.K. of Tanaka Precious Metals, which boasts the world's leading share in bonding wire manufacturing, had reported on wire shipment volumes (indicators) by material type for the year ending December 2012.

| | Shipping Volume of Bonding Wire (Indexed) |

Based on the shipment volume for 2008 (January - December), the total shipment volume of gold, copper and aluminum wire had increased by approximately 17.0% in 2012, an increase of approximately 11.4% compared to 2011. After recording the highest total shipment ever in 2010, shipment volume dropped by approximately 15.3% in 2011 due to the Great East Japan Earthquake, however, orders subsequently recovered, and a sudden increase in the shipment volume of copper wire has provided the impetus for positive growth in 2012.

Copper wire shipment volume records highest in the past approximately doubled in 2012

The shipment volume of copper wire in 2012 increased significantly by approximately 89.6% compared to 2011, which was previously the highest record. With the high level of gold prices, copper wire as an alternative to gold wire is gaining momentum, and now is being used as wiring material for ICs (integrated circuits) and LSI (large-scale integration) circuits in general purpose devices such as personal computers and smart-phones primarily from the perspective of reducing material costs.

There were issues with low quality stability because copper is more susceptible to temperature changes and moisture than gold and is oxidized easily, but Tanaka Denshi Kogyo has utilized the latest processing technology to develop and sell copper wire which could fully meet the performance requirements. Advancements in such technological development and soaring of gold price provided the circumstance for the accelerating increase in the shipment volume of copper wire that gained momentum as an alternative in 2009, and based on the volume shipped in 2008, this increased to approximately 5 times in 2009, approximately 8 times in 2010 and approximately 13 times in 2011. In 2012, the shipment volume increased to approximately 24 times the shipment of 2008, and became a product that substantially contributed to overall shipment volume.

"High demand for gold wire" has also propelled increased shipment volume

Another reason for total shipment volume records to positive growth was the high demand for gold wire. The shipment volume of gold wire in 2012 increased by approximately 3.3% compared to the previous year. Since 2009, substitution of copper wire as an alternative to gold wire has been progressing, however, since gold possess an excellent chemical properties such as corrosion resistance and conductivity, gold wire is still in high demand, and drives total shipment volume as a key player in the wire market. In particular, gold wire is required for a wide range of applications requiring high reliability such as automotive electronics and industrial equipment, and demand is expected to remain high in the future.

Furthermore, the shipment volume of aluminum wire decreased by approximately 17.0% in 2012, but has remained within a certain range over the past several years. Currently, aluminum wire is primarily used as material in large-current semiconductors such as those used in power devices, but shipment volume is expected to increase if the market expands for semiconductor materials used in next-generation power devices.

Press release: http://www.acnnewswire.com/clientreports/598/0416_EN.pdf

Tanaka Holdings Co., Ltd. (Holding company of Tanaka Precious Metals)

Headquarters: 22F, Tokyo Building, 2-7-3 Marunouchi, Chiyoda-ku, Tokyo

Representative: Hideya Okamoto, President & CEO

Founded: 1885

Incorporated: 1918

Capital: 500 million yen

Employees in consolidated group: 3,869 (FY2011)

Net sales of consolidated group: 1.064 trillion yen (FY2011)

Main businesses of the group: Manufacture, sales, import and export of precious metals (platinum, gold, silver, and others) and various types of industrial precious metals products. Recycling and refining of precious metals.

Website: http://www.tanaka.co.jp/english (Tanaka Precious Metals), http://pro.tanaka.co.jp/en (Industrial products)

Tanaka Denshi Kogyo K.K.

Head office: 22F Tokyo Building, 2-7-3 Marunouchi, Chiyoda-ku, Tokyo

Representative: Koichiro Tanaka, President & CEO

Incorporated: 1961

Capital: 1,880 million yen

Employees: 142 (FY2011)

Net sales: 33.43 billion yen (FY2011)

Businesses: Manufacture of high-purity bonding wire (gold, gold alloy, aluminum, aluminum-silicon, copper, etc.)

Website: http://www.tanaka-bondingwire.com/

About the Tanaka Precious Metals

Established in 1885, the Tanaka Precious Metals has built a diversified range of business activities focused on the use of precious metals. On April 1, 2010, the group was reorganized with Tanaka Holdings Co., Ltd. as the holding company (parent company) of the Tanaka Precious Metals. In addition to strengthening corporate governance, the company aims to improve overall service to customers by ensuring efficient management and dynamic execution of operations. Tanaka Precious Metals is committed, as a specialist corporate entity, to providing a diverse range of products through cooperation among group companies.

Tanaka Precious Metals is in the top class in Japan in terms of the volume of precious metal handled, and for many years the group has developed and stably supplied industrial precious metals, in addition to providing accessories and savings commodities utilizing precious metals. As precious metal professionals, the Group will continue to contribute to enriching people's lives in the future.

The eight core companies in the Tanaka Precious Metals are as follows.

- Tanaka Holdings Co., Ltd. (pure holding company)

- Tanaka Kikinzoku Kogyo K.K.

- Tanaka Kikinzoku Hanbai K.K.

- Tanaka Kikinzoku International K.K.

- Tanaka Denshi Kogyo K.K.

- Electroplating Engineers of Japan, Limited

- Tanaka Kikinzoku Jewelry K.K.

- Tanaka Kikinzoku Business Service K.K.

Press inquiries

Global Sales Dept., Tanaka Kikinzoku International K.K. (TKI)

https://www.tanaka.co.jp/support/req/ks_contact_e/index.html

Topic: Production report

Source: Tanaka Holdings Co., Ltd.

Sectors: Metals & Mining

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2024 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

|