|

|

|

|

|

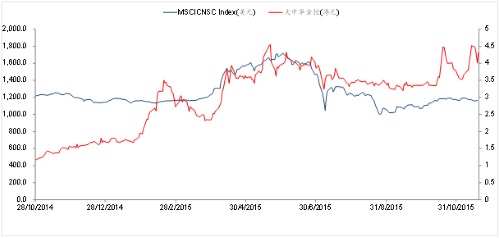

HONG KONG, Nov 20, 2015 - (ACN Newswire) - Greater China Holdings Limited ("Greater China" or "the Company;" Stock code: 00431.HK), an integrated cross-border financial service platform, has been included by Morgan Stanley Capital International (MSCI) as a constituent of the MSCI Global Small Cap Index - China, announced at 5pm (U.S. time), 12 November 2015. The MSCI Index is adjusted quarterly based on the overall performance of the shares in capital markets. The shares of 75 companies have been added to and 21 enterprises excluded from the index in the latest adjustment, effective as at the market close on 30 November.

| | Transformation of Greater China Attains Recognition of Capital Markets Included as A Constituent of the MSCI Global Small Cap Index - China |

MSCI is a leading provider of benchmark standards of global equity indexes and relative products and services to investors worldwide. MSCI indexes are among the most widely recognized investment benchmarks by international institutional investors. Constituents included in its indexes are companies with excellent performance and development potential. Based on MSCI's estimates, over 90% of institutional international equity assets in North America and Asia are benchmarked to MSCI indexes, and these indexes are tracked by 5,719 fund companies, with total assets under management reaching US$3.7 trillion.

Greater China Holdings Limited is listed on the Main Board of the Hong Kong Stock Exchange. Centering on "pushing forward financial reform to serve the real economy, and promoting the development of an inclusive financial system", the Company has completed the acquisition of the pawnshop business in the first half of 2015, and has also expanded its business scope to the financial leasing and internet finance segments in the second half of the year.

In October 2015, the Company announced the change of its English name to "Greater China Financial Holdings Limited" and the adoption of the Chinese name "Greater China Financial Holdings Limited". It has also moved its office to Times Square in Causeway Bay, one of Hong Kong's most renowned landmarks with the highest customer flow. These initiatives have opened a new chapter in the Company's development. At the same time, the Company has completed the rights issue on 19 November and received valid acceptances and applications for a total of 1,448,000,000 shares representing 6.72 times of the total number of new shares made available. The rights issue has aroused widespread recognition and interest in the capital markets. Through its connections in capital markets, as well as utilizing capital market leverage, the Company is able to accelerate the expansion of its business reach into the quasi-financial sector in China, and facilitate the rapid growth of various business segments riding on its status as a listed company. With a basis on the comprehensive licensed financial services system in Hong Kong, the Company will also expand cross-border channels for capital flow, and will link the domestic and overseas wealth management markets to create an integrated cross-border financial services platform.

Topic: Press release summary

Source: Greater China Holdings Limited

Sectors: Daily Finance, Daily News

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|