|

|

|

|

|

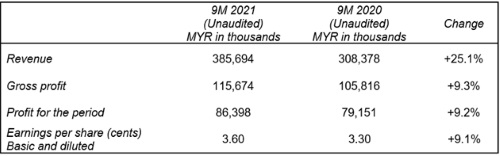

HONG KONG, Nov 1, 2021 - (ACN Newswire) - Pentamaster International Limited ("PIL" or "the Group") which is listed under the Main Board of The Stock Exchange of Hong Kong Limited announced its interim financial results for the nine months period ended 30 September 2021 ("9M2021") today. The Group recorded a new record in its quarterly revenue, with 9M2021 revenue stood at MYR385.7 million and its net profit stood at MYR86.4 million, marking an improvement of approximately 25.1% and 9.2% respectively from the corresponding period last year.

| | 9M 2021 Financial highlights |

| | Key business unit revenue and trend |

|

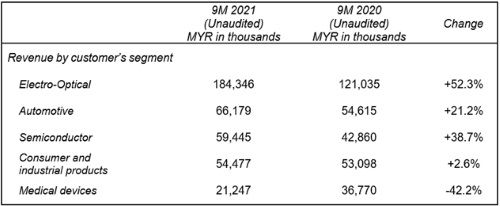

| | Revenue by customer's segment |

|

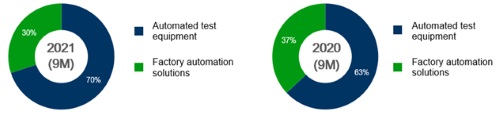

For the nine months ended 30 September 2021, the Group's revenue was contributed by both the ATE and FAS segments, with each constituting approximately 70.0% and 30.0% respectively of the Group's revenue during the Period.

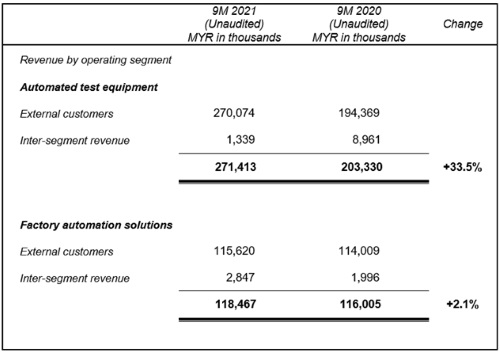

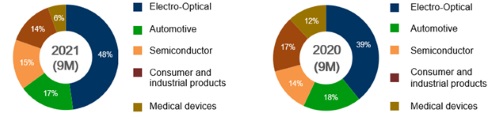

The ATE segment recorded an increase in revenue by MYR68.1 million to MYR271.4 million for the nine months ended 30 September 2021 as compared to the Previous Corresponding Period. The ATE segment, was predominantly contributed by the electro-optical segment and the automotive segment. While the electro-optical segment continued to show recovery since fourth quarter 2020, the automotive segment gained its revenue momentum in the current quarter mainly through the delivery of its test handling equipment for IPM (integrated power module), thereby closing the automotive segment's revenue during the Period with a growth rate of 21.2% as compared to the same period last year. The Group continues to see upturn in momentum from the automotive segment given the strong growth in automotive electrification and the Group's timely involvement in anchoring its position in this segment as well as geographically across key automotive markets in North Asia region and European market. In general, the global technology "super cycle" momentum will continue to provide a growth platform for the Group's ATE in the immediate term and against the backdrop of such opportunity and supply chain headwinds, the Group continues to leverage on its research and development capabilities to methodically expand its product portfolio and offerings.

Revenue from the FAS segment for the nine months ended 30 September 2021 increased by approximately 2.1% from MYR116.0 million recorded in the Previous Corresponding Period to MYR118.5 million. After marking double digit growth in 2020, the growth in the FAS segment for the nine months ended 30 September 2021 returned to its normal state given the current capacity and its projects on hand which require longer project lead time coupled with the supply chain disruptions. However, it was notable to witness a wider customer base achieved within this segment during the Period, in addition to a broader project portfolio under the application of the Group's proprietary i-ARMS (intelligent Automated Robotic Manufacturing System) solutions especially from the consumer and industrial products segment and electro-optical segment. From quarter two of 2021 to quarter three of 2021, the FAS segment marked a growth of approximately 35.2% and the Group is optimistic on the growth prospects of its FAS segment. The Group continues to witness the rapid shift of various industries towards smart manufacturing and the adoption of automation technology, more so with the effect of COVID-19 pandemic where many companies are keen to accelerate the pace of automation for better operational efficiency and digitalisation.

Outlook

On the back of a healthy order book which is fuelled by a robust market sentiment in the current "super cycle", the Group expects to end its financial year 2021 commendably with yearly revenue record achievement. As the Government of Malaysia and global economies lifting the various level of restrictions related to the COVID-19 pandemic and with the impending opening up of more cross border travelling, the Group anticipates a smoother progress in its project site installation and deployment at its customer's premise, which is an important milestone for revenue recognition to take place.

The widely-reported semiconductor shortage and supply chain constraints remained a pertinent concern to the global technology market. Towards this end, it is imperative for the Group to adjust its inventory management strategies as well as project lead time planning with its customers in order to effectively manage the challenging situation. As it is, the Group has been experiencing order intake momentum where customers across the industry segments are gradually preparing for higher levels of inventory to ensure supply security.

Looking ahead, whilst still maintaining a cautious and observance stance, the Group anticipates a more stable and favourable operating environment as global economies' are slowly opening up with the pick-up in vaccination rate. The structural shift towards a greener Earth coupled with the proliferation of artificial intelligence and Internet of Things have accelerated the massive digital transformation across key industries such as the electro-optical, automotive, and semiconductor segment. The Group as a customised solution provider with many years of experience in this level playing field, believes it is well positioned to leverage and capture the growth from these industry megatrends where such trends will continue to sustain the Group's businesses on a long term basis. The Group's continuous focus on its 3-pillar business strategies of diversification across geographical region, business segments as well as product portfolio remains key in attaining a profitable and sustainable business operation. As it is, the Group has outlined key capital expenditure in funnelling its investment in anchoring its exposure to the rapid development in technological revolution and industrial transformation to enable the Group to seize its long term business prospects.

About Pentamaster International Limited

PIL (HKEX stock code: 1665) is a leading global supplier in providing automation technology and solutions to multinational manufacturers mainly in the semiconductor, automotive, electrical & electronics, medical devices and consumer industrial products sectors spanning APAC, North America and Europe. The Group's broad range of integrated automation products and solutions entails innovating, designing, manufacturing and installing automated equipment and/or automated manufacturing solutions.

To learn more about PIL, please visit us at www.pentamaster.com.my

For media enquiries, please contact:

Pentamaster International Limited

Email: investor.relation@pentamaster.com.my

ICA Investor Relations (Asia) Limited

E-mail: pentamaster@icaasia.com

Topic: Press release summary

Source: Pentamaster International Limited

Sectors: Electronics, Automation [IoT]

https://www.acnnewswire.com

From the Asia Corporate News Network

Copyright © 2026 ACN Newswire. All rights reserved. A division of Asia Corporate News Network.

|

|

|

|

|

|

|

|